The domestic graphite electrode market price continued to stabilize this week. Since June is the traditional off-season in the steel market, the demand for graphite electrode purchases has decreased, and the overall market transaction appears relatively light. However, affected by the cost of raw materials, the price of high-power and ultra-high-power graphite electrodes is still stable.

Good news in the market this week continued. First of all, according to US media reports on June 14, the spokesperson of the relevant Iranian department stated that it had reached a major agreement with the United States: the United States will lift the sanctions on all Iranian industries including energy during the Trump period. The removal of sanctions may benefit the export of domestic electrodes. Although it is impossible to achieve this in the third quarter, the export market will definitely change in the fourth quarter or next year. Secondly, in the third quarter of the Indian market, overseas oil-based needle coke will be raised from the current US$1500-1800/ton to more than US$2000/ton. In the second half of the year, the supply of overseas oil-based needle coke is tight. We have also reported before that it seems that it has not only affected the domestic market, so it will play a role in supporting the stability of electrode prices in the later period.

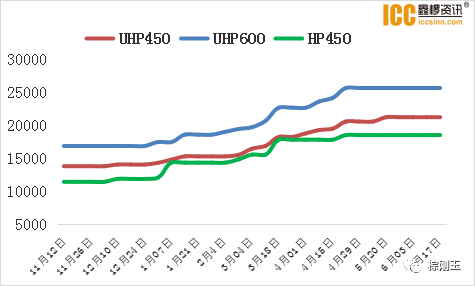

As of this Thursday, the mainstream price of UHP450mm specifications with 30% needle coke content on the market is 205-2.1 million yuan/ton, the mainstream price of UHP600mm specifications is maintained at 25,000-27,000 yuan/ton, and the price of UHP700mm is maintained at 30,000-32,000 yuan/ton.

About Raw Material

The raw material market continued to be stable this week. Daqing Petrochemical 1#A petroleum coke was quoted at 3,200 yuan/ton, Fushun Petrochemical 1#A petroleum coke was quoted at 3400 yuan/ton, and low-sulfur calcined coke was quoted at 4200-4400 yuan/ton.

Needle coke prices have been steadily rising this week. Baotailong’s ex-factory price has been raised by RMB 500/ton, while other manufacturers have temporarily stabilized. At present, the mainstream prices of domestic coal-based and oil-based products are 8500-11000 yuan/ton.

Steel mills

This week, domestic steel prices fluctuated and fell by 70-80 yuan/ton. Relevant regions have further increased energy consumption dual control efforts to ensure the completion of the annual energy consumption dual control targets in the region. Recently, electric furnace steel in Guangdong, Yunnan and Zhejiang regions Plants have encountered production restrictions successively. The output of electric furnace steel has declined for 5 consecutive weeks, and the operating rate of electric furnace steel has dropped to 79%.

At present, some domestic independent electric furnace steel mills are in the vicinity of break-even. Coupled with sales pressure, short-term production is expected to continue to increase, and scrap steel prices are facing greater resistance. As of this Thursday, taking Jiangsu electric furnace as an example, the profit of electric furnace steel is -7 yuan/ton.

Forecast of future market prices

Petroleum coke prices are showing signs of stabilization. Needle coke market prices will mainly stabilize and rise, and the operating rate of electric furnace steel will show a slow downward trend, but it will still be higher than the level of the same period last year. In the short term, the market price of graphite electrodes will continue to be stable.

Post time: Jun-30-2021