In 2021, the price of petroleum coke has continuously hit new highs. In September, the price of petroleum coke has ushered in a wave of sharp rise. The price change cannot be separated from the basic change of supply and demand. After this round, how is the situation, let’s take a look.

The ultimate logic that determines the direction of supply and demand depends on the most basic law: inventory in the short term, profits in the medium term and capacity in the long term. The tilt of supply and demand determines the price trend of products, so let’s take a look at the price trend of petroleum coke. Figure 1 shows the price trend of petroleum coke, residue and Brent (the prices of petroleum coke and residue are all taken from the mainstream price of Shandong Refinery). Residue price keeps synchronous trend with international oil price Brent, but the trend trend of petroleum coke price and residue and international oil price Brent is not obvious. Is it tight supply, demand-driven, or other factors that will see strong price increases in 2021?

Inventories at present, the domestic petroleum coke removing the port, refinery inventory, downstream calcining plant, pigment plant inventory are unable to get the accurate inventory data in detail, thus cannot be concluded that the changes of supply and demand change inventory, but at present the research samples, sample to refining, for example, as of early September to refining stocks have been low, and sustained declined slightly, There is no large amount of exhaustion due to the price rise, that is, the current refinery is still in the warehouse stage.

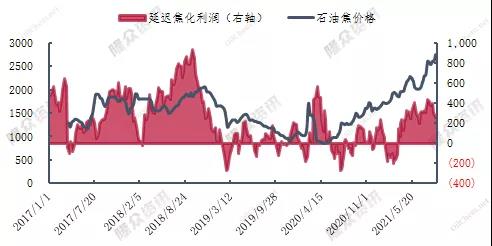

Figure 2 for delayed coking profits with petroleum coke price charts (delayed coking profits, petroleum coke prices from shandong area), the current oil prices are high, delayed coking relatively profitable, but combined with figure 3 domestic petroleum coke yield changes, considerable profit of delayed coking has not caused the increase of the supply of petroleum coke production, This is related to the fact that petroleum coke is a subsidiary product with less output in refining and chemical industry. The start-up and load of delayed coking unit will not be completely adjusted by petroleum coke.

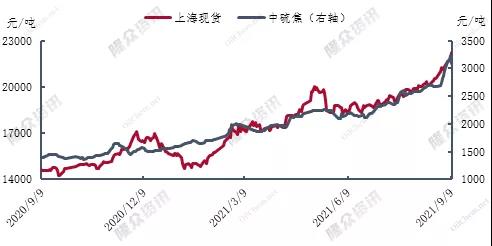

Figure 4 for sulfur in the focal spot price chart with Shanghai, for domestic sulfur coke used in most of the flow direction of aluminium with carbon, so take the two prices, figure 4 shows relative price movements between the trend, especially in 2021, rising prices support the electrolytic aluminium enterprise active, chinalco, for example, in the first half of this year, chinalco to achieve revenue super billions, A year-on-year increase of nearly 40 billion yuan, net profit attributable to shareholders of listed companies (referred to as net profit) 3.075 billion yuan, up 85 times.

In conclusion, 2021 petroleum coke prices rising, more and more is pulled from the demand side, and the petroleum coke prices higher, did not make the supply side to increase production, the demand side has yet to appear obvious abate signal, supply side in the near future or have device starts, but imports tend to be off-season, construction of delayed coking device can increase the supply and demand of the current tension ease? As far as the current situation is concerned, unless the supply side appears a large number of production, or the downstream demand direction appears relevant major adjustment, otherwise, the current tense supply and demand relationship is difficult to have a significant change, the oil coke price is also difficult to have a significant callback.

Post time: Sep-18-2021