Low-sulfur calcined coke

In the second quarter of 2021, the low-sulfur calcined coke market was under pressure. The market was relatively stable in April. The market began to decline sharply in May. After five downward adjustments, the price dropped by RMB 1100-1500/ton from the end of March. The sharp drop in market prices is mainly due to two factors. First, the raw materials have significantly weakened in the face of market support; since May, the supply of low-sulfur petroleum coke for electrodes has increased. Fushun Petrochemical and Dagang Petrochemical coking plants have resumed operations, and some petroleum coke prices have been under pressure. It fell by RMB 400-2000/ton and sold at an insured price, which is bad for the low-sulfur calcined coke market. Secondly, the price of low-sulfur calcined coke rose too fast in March-April. In early May, the price exceeded the downstream acceptance range, and enterprises concentrated on lowering prices, which caused shipments to be significantly blocked. In terms of market, the low-sulfur calcined coke market was generally traded in April. The price of coke rose by 300 yuan/ton at the beginning of the month, and has been stable since then. At the end of the month, corporate inventories have increased significantly; the low-sulfur calcined coke market performed in a downturn in May, and actual market transactions were scarce. Enterprise inventory is at a mid-to-high level; in June, the low-sulfur calcined coke market was poorly traded, and the price fell by 100-300 yuan/ton from the end of May. The main reason for the price reduction was that the downstream receiving goods were not actively received and the wait-and-see mentality was serious; throughout the second quarter, Fushun, Fushun, The shipment of high-end low-sulfur calcined coke with Daqing petroleum coke as raw material is under pressure; the shipment of low-sulfur calcined coke for carbon agent is acceptable, and the market for ordinary low-sulfur calcined coke for electrodes is not good. As of June 29, the low-sulfur calcined coke market has slightly improved. The mainstream low-sulfur calcined coke (Jinxi petroleum coke as a raw material) market has a mainstream factory turnover of 3,500-3900 yuan/ton; low-sulfur calcined coke (Fushun Petroleum Coke) As raw materials), the mainstream market turnover is 4500-4900 yuan/ton from the factory, and the low-sulfur calcined coke (Liaohe Jinzhou Binzhou CNOOC Petroleum Coke as the raw material) market mainstream turnover is 3500-3600 yuan/ton.

Medium and high sulfur calcined coke

In the second quarter of 2021, the medium and high-sulfur calcined coke market maintained a good momentum, with coke prices rising by about RMB 200/ton from the end of the first quarter. In the second quarter, the China Sulfur Petroleum Coke price index rose by about 149 yuan/ton, and the price of raw materials was still mainly rising, which strongly supported the price of calcined coke. In terms of supply, two new calciners were put into operation in the second quarter, one for commercial calcined coke, Yulin Tengdaxing Energy Co., Ltd., with an annual production capacity of 60,000 tons/year, and it was put into operation in early April; the other for supporting calcined coke, Yunnan Suotongyun The first phase of Aluminium Carbon Material Co., Ltd. is 500,000 tons/year, and it will be put into operation at the end of June. The total output of commercial medium and high-sulfur calcined coke in the second quarter increased by 19,500 tons compared with the first quarter. The increase was mainly due to the release of new production capacity; environmental protection inspections in Weifang, Shandong, Shijiazhuang, Hebei, and Tianjin are still strict, and some companies have reduced output. In terms of demand, the market demand for medium and high sulfur calcined coke remained good in the second quarter, with strong demand from aluminum plants in Northwest China and Inner Mongolia. In terms of market conditions, the mid-to-high-sulfur calcined coke market was stable in April, and most companies can balance production and sales; market enthusiasm for trading has slowed slightly compared with the end of March, and the full-month coke price has been raised by 50-150 yuan/ton from the end of March; 5 The medium and high sulfur calcined coke market was well traded in the month, and the market was basically in short supply for the whole month. The market price increased by 150-200 yuan/ton from the end of April; the medium and high sulfur calcined coke market was stable in June, and there was no shipment in the whole month. Mainstream prices remain stable, and actual prices in individual regions have fallen by about 100 yuan/ton following the decline in raw materials. In terms of price, as of June 29, all types of high-sulfur calcined coke were shipped without pressure in June, but the market has slowed down slightly from the end of May; in terms of price, as of June 29, no trace element calcined coke was required to leave the factory. Mainstream transactions are 2550-2650 yuan/ton; sulfur is 3.0%, only requiring vanadium within 450 yuan, and other trace amounts of medium-sulfur calcined coke factory mainstream acceptance prices are 2750-2900 yuan/ton; all trace elements are required to be within 300 yuan, sulfur Calcined coke with a content of less than 2.0% will be delivered to the mainstream at around RMB 3200/ton; sulfur 3.0%, the price of calcined coke with high-end export (strict trace elements) indicators needs to be negotiated with the company.

Export side

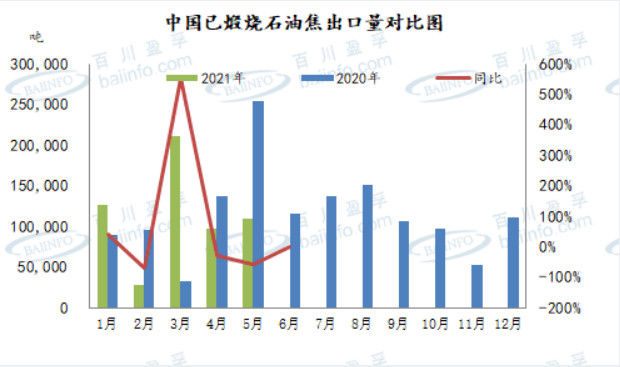

In terms of exports, China’s calcined coke exports in the second quarter were relatively normal, with monthly exports maintained at around 100,000 tons, 98,000 tons in April and 110,000 tons in May. The export countries are mainly the UAE, Australia, Belgium, Saudi Arabia, Mainly from South Africa.

Market outlook forecast

Low-sulfur calcined coke: The low-sulfur calcined coke market has seen a good improvement at the end of June. The price is expected to rise by 150 yuan/ton in July. The market will be stable in August, and the stock will be supported in September. The price is expected to continue to rise by 100 yuan. /Ton.

Medium and high sulfur calcined coke: The medium and high sulfur calcined coke market is currently trading well. Environmental protection is expected to continue to affect the production of calcined coke in some provinces in Hebei and Shandong, and the market demand is still strong in the third quarter. Therefore, Baichuan expects the medium and high sulfur calcined coke market to rise slightly in July and August. , The total margin in the second quarter is expected to be around 150 yuan/ton.

Post time: Aug-05-2021