The 2022 Winter Olympics will be held in Beijing and Zhangjiakou, Hebei province from February 4 to February 20. During this period, the domestic petroleum coke production enterprises have been greatly affected, shandong, Hebei, Tianjin area, most of the refinery coking device has different degrees of production reduction, production, individual refineries take this opportunity, the coking device maintenance date in advance, the market oil coke supply significantly reduced.

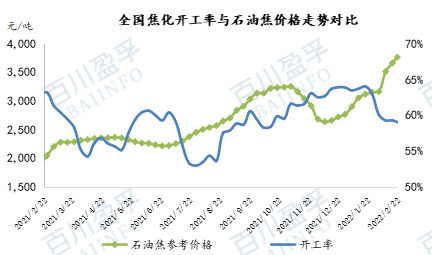

And because march and April are the peak season of refinery coking unit maintenance in the past years, the supply of petroleum coke will be further reduced, traders take this opportunity to enter the market in large quantities to purchase, pushing up the price of petroleum coke. As of February 22, the national reference price of petroleum coke 3766 yuan/ton, compared with January up 654 yuan/ton or 21.01%.

February 21 as Beijing Olympics officially ended, the winter Olympics environmental policy gradually lifted, the early stage of the shutdown and overhaul of refinery and downstream carbon enterprise gradually restored, and vehicle control, logistics market returned to normal, the downstream enterprises due to the low upfront petroleum coke inventory of raw material, began to actively stock inventory and demand for petroleum coke is good.

In terms of port inventory, there are fewer ships arriving in Hong Kong recently, and some ports have no petroleum coke inventory. In addition, domestic petroleum coke prices have risen rapidly, and shipments from major ports in East China, Along the Yangtze River and northeast China have accelerated, while shipments from ports in South China have decreased, mainly due to the greater impact of the epidemic in Guangxi.

March and April will soon enter the peak season of refinery maintenance. The following table is the national coking unit maintenance schedule according to Statistics of Baichuan Yingfu. Among them, 6 new main refineries have been suspended for maintenance, affecting the capacity of 9.2 million tons. Local refineries are expected to add 4 more shutdown refineries for maintenance, affecting coking units with an annual capacity of 6 million tons. Baichuan Yingfu will continue to update the maintenance of coking device of subsequent refineries.

In summary, the oil coke market supply continues to be tight, refinery oil coke inventory are low; Stacking the end of the Winter Olympics, the downstream carbon enterprises actively purchase, the demand for petroleum coke further increased; Anode materials, electrode market demand is good. Baichuan Yingfu is expected to low sulfur petroleum coke prices will continue to push up 100-200 yuan/ton, medium-high sulfur petroleum coke prices still show an upward trend, the range of 100-300 yuan/ton.

Post time: Feb-25-2022