Today’s review

Today (2022.4.19) China petroleum coke market as a whole mixed. Three main refinery coke prices continue to push up, part of the coking price continues to decline.

Low sulfur coke in the new energy market driven, anode materials and steel with carbon demand increases, low sulfur coke prices are constantly high. In addition to being driven by low sulfur coke, the price of aluminum is strong, aluminum enterprises maintain a higher start load, demand side to give high sulfur coke up. However, as the price of petroleum coke continues to rise, the enthusiasm of downstream carbon enterprises to receive goods due to financial stress weakened, the market transaction is relatively light resulting in refinery inventory increase, the refinery began to fall.

Future outlook:

The refinery load is still low, the terminal demand performance is fair, the petroleum coke is supported by the supply and demand side is strong, but the high petroleum coke leads to the downstream capital tension, the short-term petroleum coke price is generally stable, part of the coking price has continued to fall risk, in the medium term, the petroleum coke or continue to strong situation.

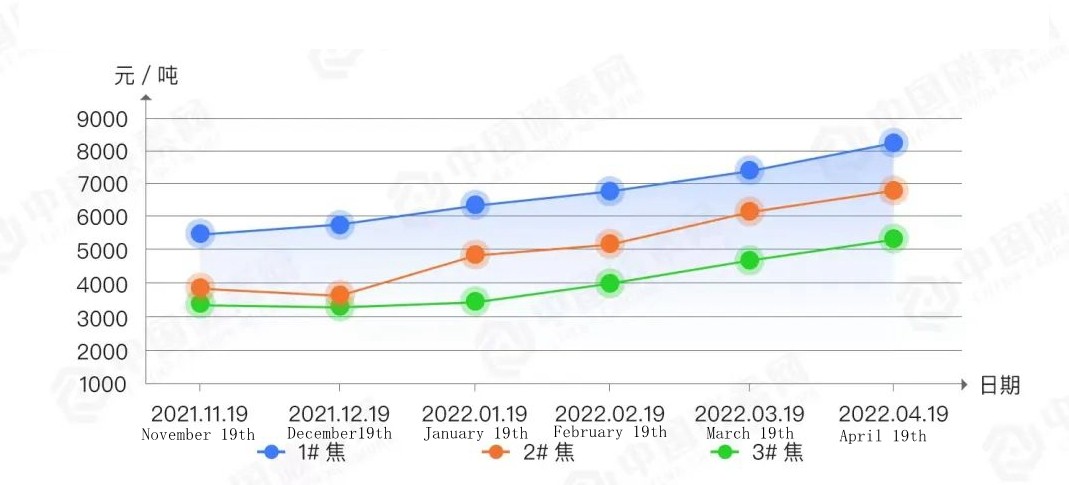

Petroleum coke price trend chart in the past six months

Post time: Apr-21-2022