In August, the domestic main petroleum coke market had good trading, the refinery delayed the start of the coking unit, and the demand side had good enthusiasm for entering the market. The refinery inventory was low. Many positive factors led to the continued upward trend of refinery coke prices.

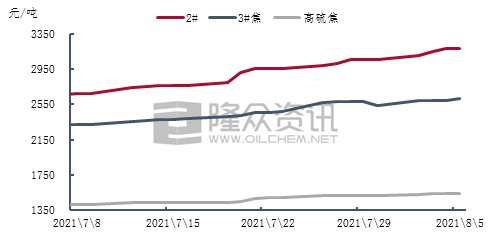

Figure 1 The weekly average price trend of domestic medium and high sulfur petroleum coke

Recently, domestic production and sales of medium and high-sulfur petroleum coke have been basically stable, and the price of refinery coke has risen again. Affected by the epidemic, high-speed roads have been closed in some areas of East China, and individual refineries have limited auto shipments, shipments have been good, and refinery inventories have been operating at low levels. The downstream carbon market maintained normal production, and the terminal electrolytic aluminum price continued to fluctuate above 19,800 yuan/ton. The demand side favored petroleum coke shipments for export, and refinery coke prices continued to rise. Among them, the average weekly price of 2# coke was 2962 yuan/ton, an increase of 3.1% from last week, the average weekly price of 3# coke was 2585 yuan/ton, an increase of 1.17% from the previous month, and the average weekly price of high-sulfur coke was 1536 yuan/ton, a month-on-month increase. An increase of 1.39%.

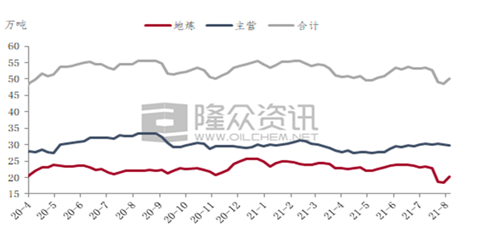

Figure 2 Trend chart of domestic petcoke change

Figure 2 shows that the domestic main petroleum coke production is basically stable. Although the output of some Sinopec refineries along the Yangtze River has declined slightly, some refineries have resumed production following the preliminary maintenance, and the production of Zhoushan Petrochemical has resumed after the typhoon. There has been no significant increase or decrease in the supply of petroleum coke for the time being. . According to statistics from Longzhong Information, the domestic main petcoke production in the first week of August was 298,700 tons, accounting for 59.7% of the total weekly production, a decrease of 0.43% from the previous week.

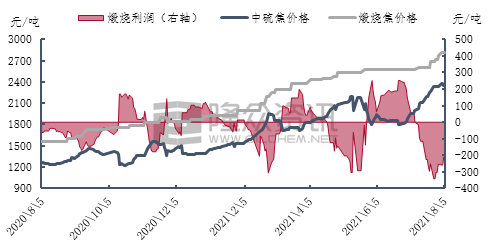

Figure 3 Profit trend chart of China sulfur calcined coke

Recently, the output of calcined coke in Henan and Hebei has declined slightly due to heavy rains and environmental inspections, and the production and sales of calcined coke in East China and Shandong have been normal. Driven by the cost of raw materials, the price of calcined coke continues to rise. The overall market for medium and high-sulfur calcined coke is good, and the calcining companies basically have no finished product inventory. At present, some companies have signed orders in August. The operating rate of calcined coke is basically stable, and there is no pressure on production and sales. Although traffic restrictions on some road sections in East China have a certain impact on petroleum coke shipments, the impact on shipments and purchases of calcining companies is limited, and some companies’ raw material inventory can be produced for about 15 days. Enterprises in Henan that were affected by the rainstorm in the early stage are gradually returning to normal production and sales. Recently, they have mainly executed backlog orders and limited price adjustments.

Market outlook forecast:

In the short term, the supply of main refineries in the domestic petcoke market has basically remained stable, and the supply of petrocoke from local refineries has gradually recovered. The output in mid-to-early August was still at a low level. The demand side procurement enthusiasm is acceptable, and the end market is still favorable. It is expected that the petroleum coke market will mostly be active in shipments. Due to the decline in the external sales of high-sulfur coke under the influence of high coal prices, the market price of high-sulfur petroleum coke in the next cycle is still likely to increase slightly.

Post time: Aug-09-2021