1. Market hotspots:

Longzhong information learned: Cloud aluminum shares (000807) on November 22 morning announcement, November 18 at about 19 o ‘clock, the company’s wholly-owned subsidiary Yunnan Wenshan Aluminum Co., LTD. Electrolytic zone no. 1628 electrolytic tank leakage occurred. After the accident, Cloud Aluminum Co., Ltd. immediately launched the emergency plan, orderly rescue and disposal, the device has realized live production on 22nd.

2. Market Overview:

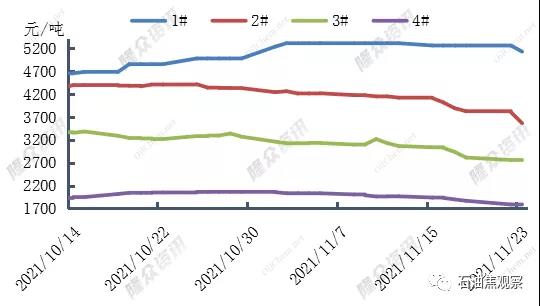

Longzhong Information November 23: today’s domestic petroleum coke market trading in general, the mainstream coke price individually fell, part of the coke refining price continued to decline. In the main business, some refineries of Cnooc slowed down shipments, coke prices down 150-200 yuan/ton. Northeast ordinary quality low sulfur coke shipment pressure, Jinzhou petrochemical coke price wide down 700 yuan/ton. Northwest trading fair, refinery trading normal, coke high steady. In terms of local refineries, refinery trading was general, demand at the demand end turned weak, refinery inventory increased, coke price dropped 30-300 yuan/ton. Beijing bo petrochemical index adjusted for sulfur content 1.7%.

3. Supply Analysis:

Today’s domestic production of petroleum coke 79400 tons, a sequential increase of 100 tons or 0.13%. Individual refinery output adjustment.

4. Demand Analysis:

Shandong, Hebei and other places continue to maintain power rationing policies, except for some waste heat power generation enterprises in the region has little impact, other enterprises mostly maintain low load operation; The overall production status of enterprises in southwest China is relatively good, and the power restriction area maintains the early load. The output of some new carbon enterprises this year releases a high level, and the production will be full at the end of December, mainly for local and south China market, and the overall low level of market supply is stable. Steel carbon market trading is not good, graphite electrode and carburizer market shipments slow, limited positive support for petroleum coke.

5. Price Forecast:

Recent domestic petroleum coke resource supply is abundant, the demand side into the market enthusiasm is general, some refineries coke prices continue to decline. In the short term, the domestic petroleum coke market is mainly organized, the mainstream market coke price is largely stable, and part of the coke price is still downward.

Post time: Nov-24-2021