1. Market hotspots:

Lonzhong News: According to the data released by the National Bureau of Statistics, manufacturing PMI was 50.1 in August, down 0.6% month-on-month and 1.76% year on year, which continued to remain in the expansion range and the expansion intensity weakened.

2. Market Overview:

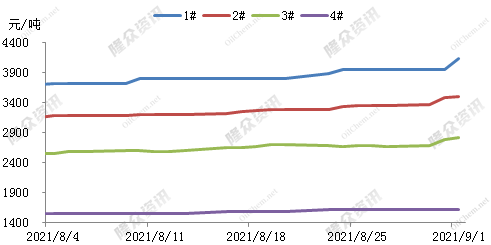

Domestic oil coke price trend chart

Longzhong Information September 1: today’s oil coke market price on the broad line, the market trading atmosphere is better. Main area, the northeast ordinary quality 1 petroleum coke prices up 200-400 yuan/ton. Smooth shipment, low inventory. Petrochemical, CNOOC stable price operation. Low sulfur oil coke supply tight market pattern in a short time can not be alleviated. In terms of refining, the sulfur index in Shandong refining is greatly increased, and the price of high sulfur is stable. Refinery overall inventory no pressure. Petroleum coke demand as a whole is better, market prices are rising steadily.

3. Supply Analysis:

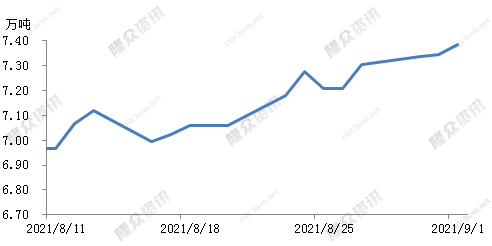

Today, the national petroleum coke output of 73580 tons, a sequential increase of 420 tons or 0.57%. Zhoushan petrochemical production, Jincheng is expected to overhaul a coking unit tomorrow, production reduction of 300-400 tons/day.

4. Demand Analysis:

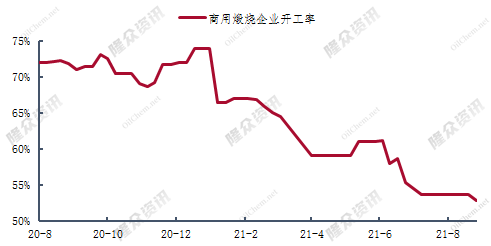

The domestic calcined burning market has good shipment, the raw material cost has driven the calcined burning price to a high, the profit of calcination turns from deficit to surplus, and the calcination enterprise starts work steadily. The price of terminal electrolytic aluminum rose again to 21230 yuan/ton, electrolytic aluminum enterprises to maintain high profits and high construction, strong support for aluminum carbon market. Carburizer and graphite electrode market trading is general, the downstream demand is relatively weak. Negative market trading is positive, more enterprise orders, good low – sulfur coke market shipment volume.

5. Price Forecast:

Petroleum coke market short-term high shock possibility is larger, aluminum prices repeatedly record highs, aluminum with carbon market support strong. The negative electrode procurement concentration, part of the negative electrode enterprises can accept a certain degree of premium. Electrode enterprises wait and see, steel mills in the future start to improve the current inquiry electrode market is more positive, coupled with the import of petroleum coke resources rose sharply, support the current domestic petroleum coke market steady upward, “gold nine silver ten” downstream industry traditional peak season is coming, the market attitude is positive.

Post time: Sep-02-2021