1. Price data

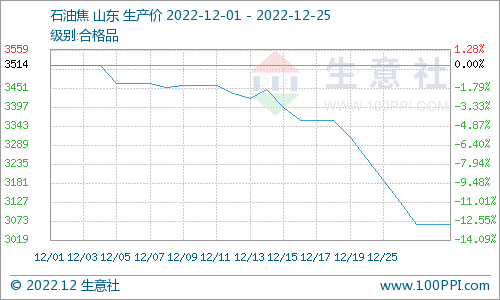

The average price of petroleum coke in Shandong on December 25 was 3,064.00 yuan per ton, down 7.40% from 3,309.00 yuan per ton on December 19, according to data from the trade agency Bulk List.

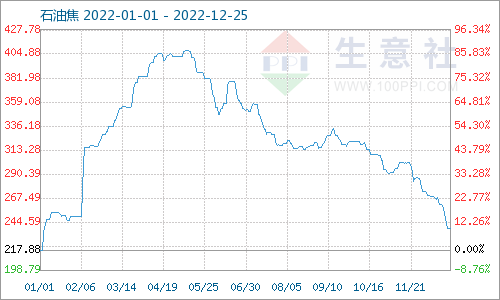

On December 25, the petroleum coke commodity index stood at 238.31, unchanged from yesterday, down 41.69% from the cycle peak of 408.70 (2022-05-11) and up 256.27% from the lowest point of 66.89 on March 28, 2016. (Note: Period from September 30, 2012 to now)

2. Analysis of influencing factors

This week, refinery oil coke prices fell sharply, refining enterprises in general, oil coke market supply is sufficient, refinery inventory reduction shipment.

Upstream: International crude oil prices rose as the Federal Reserve signaled that interest rate hikes are far from over and that it is not near the end of monetary tightening. The lingering economic heat in the first half of December raised concerns that the Fed was turning from a dove to a hawk, which could frustrate the central bank’s earlier hopes of slowing rate hikes. The market has provided the case for the Fed to keep inflation in check and keep monetary tightening path, which has led to a broad decline in risk assets. Coupled with the overall economic weakness, the severe pandemic in Asia continues to weigh on demand expectations, the outlook for energy demand remains unfavourable, and the economic weakness has weighed on oil prices, which fell sharply in the first half of the month. Oil prices recovered losses in the second half of the month after Russia said it might cut oil production in response to the G7 price cap on Russian oil exports, tightening expectations and news that the U.S. plans to buy strategic oil reserves.

Downstream: calcined char prices down slightly this week; Silicon metal market prices continue to decline; The price of electrolytic aluminum downstream fluctuated and rose. By December 25, the price was 18803.33 yuan/ton; At present, downstream carbon enterprises are under great financial pressure, wait-and-see sentiment is strong, and procurement is based on demand.

Business news petroleum coke analysts believe: international crude oil rose this week, petroleum coke cost support; At present, the domestic petroleum coke inventory is high, and the refiners are shipping at a lower price to remove inventory. The downstream receiving enthusiasm is general, the wait-and-see sentiment is strong, and the demand purchase is slow. It is expected that the price of petroleum coke will continue to decline in the near future.

Post time: Dec-29-2022