With the continuous escalation of the conflict between Russia and Ukraine, Russia and Ukraine as China’s graphite electrode export countries, will form a certain impact on China’s graphite electrode export?

First, raw materials

The war between Russia and Ukraine has amplified the volatility in the oil market, and with low inventories and a dearth of spare capacity around the world, it may be only the surge in oil prices that will dampen demand. Affected by crude oil market fluctuations, domestic petroleum coke, needle coke prices show a turn to rise.

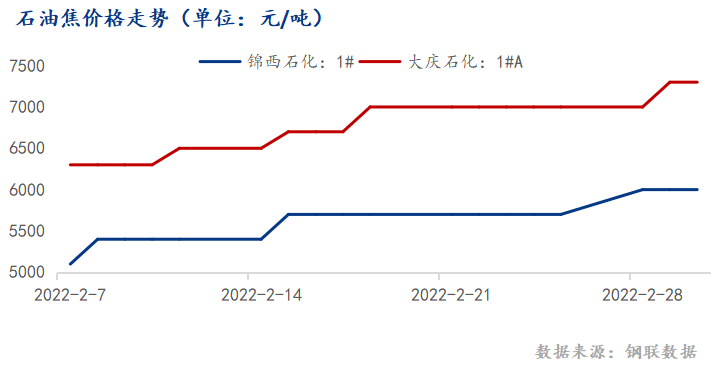

The price of petroleum coke after the holiday showed three consecutive rises, even four consecutive rises, as of press release, jinxi petrochemical coking price of 6000 yuan/ton, up 900 yuan/ton on a year-on-year basis, Daqing Petrochemical price of 7300 yuan/ton, up 1000 yuan/ton on a year-on-year basis.

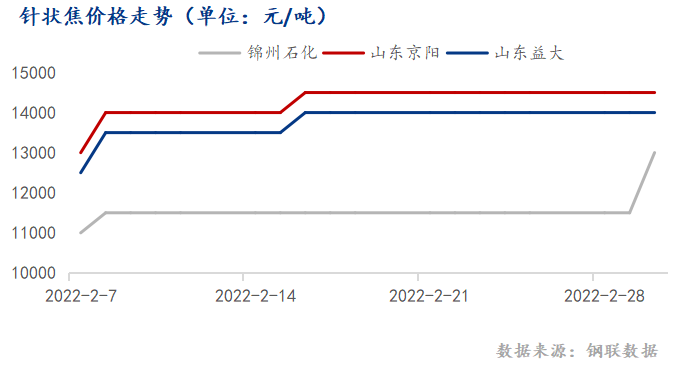

Needle coke, after the festival showed a double rise, oil needle coke the biggest increase of 2000 yuan/ton, as of press, domestic graphite electrode oil needle coke cooked coke price of 13,000-14,000 yuan/ton, the average monthly increase of 2000 yuan/ton. Imported oil series needle coke cooked coke 2000-2200 yuan/ton, affected by oil series needle coke, coal series needle coke price also rose to a certain extent, domestic graphite electrode with coal series needle coke cooked coke offer 110-12,000 yuan/ton, the average monthly increase of 750 yuan/ton. Imported graphite electrode with coal needle coke coke quoted 1450-1700 USD/ton.

Russia is one of the world’s top three oil producers, accounting for 12.1% of global crude oil production in 2020, with exports mainly to Europe and China. In general, the duration of the Russia-Ukraine war in the later period will have a great impact on oil prices. If the “blitzkrieg” war turns into a “sustained war”, it is expected to have a sustained boosting effect on oil prices. And if subsequent peace talks go well and the war ends soon, that could put downward pressure on oil prices, which have been pushed higher. As a result, oil prices will remain dominated in the short term by the russian-Ukrainian situation. From this point of view, the cost of graphite electrode is still uncertain.

Second, export

In 2021, China’s output of graphite electrode was about 1.1 million tons, of which 425,900 tons were exported, accounting for 34.49% of China’s annual output of graphite electrode. In 2021, China exported 39,400 tons of graphite electrodes from The Russian Federation and 16,400 tons from Ukraine, accounting for 13.10% of the total exports in 2021 and 5.07% of China’s annual output of graphite electrodes.

In the first three quarters of 2021, China’s output of graphite electrode is about 240,000 tons. In terms of environmental protection production limits in Henan, Hebei, Shanxi and Shandong, the first quarter of 2022 May see a year-on-year decline of about 40%. In the first quarter of 2021, China exported a total of 0.7900 tons of graphite electrodes from the Russian Federation and Ukraine, which actually accounted for less than 6%.

At present, the downstream blast furnace, electric furnace and non-steel industry of graphite electrode resume production one after another, the purchase of “buy up not buy down” in mind, a small decline in exports may be difficult to have a certain impact on the domestic graphite electrode market.

Therefore, overall, in the short term, cost is still the main factor affecting China’s graphite electrode market, and the recovery of demand is the role of combustion.

Post time: Mar-04-2022