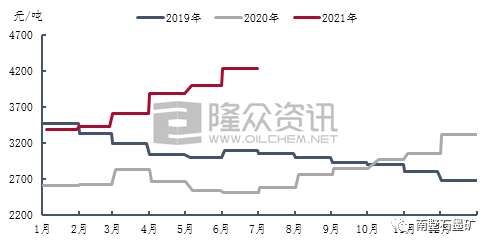

In the first half of the year, the domestic petroleum coke market trading was good, and the overall price of medium and high sulfur petroleum coke showed a fluctuating upward trend. From January to may, due to the tight supply and strong demand, the price of coke continued to rise sharply. From June, with the recovery of supply, the price of some coke fell, but the overall market price was still far higher than that of the same period last year.

In the first quarter, the overall market turnover was good. Supported by the demand side market around the Spring Festival, the price of petroleum coke showed a climbing trend. Since late March, due to the high price of medium and high sulfur coke in the early stage, the downstream receiving operation slowed down, and the coke price of some refineries fell. Due to the relatively concentrated overhaul of domestic petroleum coke in the second quarter, the supply of petroleum coke decreased significantly, but the demand side performance was acceptable, which still had good support for the petroleum coke market. However, after entering June, the inspection and refining plants began to resume production one after another, and the electrolytic aluminum industry in North China and southwest China frequently exposed bad news. In addition, the shortage of funds in the intermediate carbon industry and the bearish attitude towards the market restricted the procurement rhythm of downstream enterprises, and the petroleum coke market entered the consolidation stage again.

According to the data analysis of Longzhong information, the average price of 2A petroleum coke was 2653 yuan / ton, up 1388 yuan / ton from the first half of 2021, or 109.72%. At the end of March, the price of coke rose to a peak of 2700 yuan / ton in the first half of the year, with a year-on-year increase of 184.21%. The price of 3B petroleum coke was obviously affected by the centralized maintenance of the refinery. The price of 3B petroleum coke continued to climb in the second quarter. In the middle of May, the price of 3B petroleum coke rose to 2370 yuan / ton, the highest level in the first half of the year, with a year-on-year increase of 111.48%. The average price of high sulfur coke in the first half of the year was 1455 yuan / ton, with a year-on-year increase of 93.23%.

Driven by the price of raw materials, in the first half of 2021, the price of domestic medium sulfur calcined coke showed a ladder upward trend, the overall turnover of calcination market was good, and the demand side procurement was stable, which was good for calcination enterprises to ship.

According to the data analysis of Longzhong information, the average price of medium sulfur calcined coke in the first half of 2021 was 2213 yuan / ton, an increase of 880 yuan / ton or 66.02% compared with that in the first half of 2020. In the first quarter, the overall trading volume of medium and high sulfur market was good. In the first quarter, the sulfur content of 3.0% ordinary calcined coke was increased by 600 yuan / ton, and the average price was 2187 yuan / ton. The total price of 300pm calcined coke with sulfur content of 3.0% and vanadium content increased 480 yuan / ton, and the average price was 2370 yuan / ton. In the second quarter, the domestic supply of medium and high sulfur petroleum coke decreased, and the coke price continued to rise sharply. However, the purchasing enthusiasm of downstream carbon enterprises was limited. Calcining enterprises, as an intermediate link in the carbon market, had less voice, production profits continued to decline, cost pressure continued to increase, and the driving speed of calcined coke price slowed down. As of June, with the recovery of domestic medium and high sulfur coke supply, the price of some coke fell, the production profit of calcining enterprises turned from loss to profit, the transaction price of common calcined coke with sulfur content of 3% was adjusted to 2650 yuan / ton, and the transaction price of calcined coke with sulfur content of 3.0% and vanadium content of 300pm was increased to 2950 yuan / ton.

In 2021, the domestic prebaked anode price continued to rise, pushing up 910 yuan / ton from January to June. As of June, the benchmark price of prebaked anode in Shandong has risen to 4225 yuan / ton. Due to the rising price of raw materials and the increasing production pressure of prebaked anode enterprises, the price of coal tar pitch rose sharply in May. Supported by the cost, the price of prebaked anode rose sharply. In June, with the drop of coal tar pitch delivery price and partial adjustment of petroleum coke price, the production profit of prebaked anode enterprises rebounded.

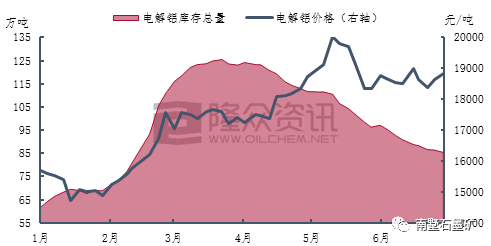

Since 2021, the domestic electrolytic aluminum industry has maintained a high price and high profit situation. The price profit of single ton electrolytic aluminum can reach 5000 yuan / ton or more, and the utilization rate of domestic electrolytic aluminum capacity once maintained near 90%. Since June, the overall start-up of the electrolytic aluminum industry has declined slightly. Yunnan, Inner Mongolia and Guizhou have successively increased the control of the high energy consuming industries such as electrolytic aluminum, and the situation of electrolytic aluminum warehouse removal has been increasing. As of the end of June, the domestic electrolytic aluminum inventory has dropped to about 850000 tons.

According to Longzhong information data, the domestic electrolytic aluminum production in the first half of 2021 was about 19350000 tons, an increase of 1.17 million tons or 6.4% year on year. In the first half of the year, the average price of spot aluminum in Shanghai was 17454 yuan / ton, an increase of 4210 yuan / ton, or 31.79% year on year. The market price of electrolytic aluminum continued to fluctuate and rise from January to May. In mid May, the spot aluminum price in Shanghai rose to 20030 yuan / ton, reaching the high level of electrolytic aluminum price in the first half of the year, up 7020 yuan / ton, or 53.96% year on year.

Post market forecast:

In the second half of the year, some domestic refineries still have maintenance plans, but with the start of the previous inspection and repair plants, the domestic oil coke supply has little influence. The start-up of downstream carbon enterprises is relatively stable, and the new production capacity and recovery capacity of terminal electrolytic aluminum market may increase. However, due to the control of double carbon target, the output growth is expected to be limited. Even if the state releases the supply pressure by throwing storage, the price of electrolytic aluminum remains high and volatile. At present, the electrolytic aluminum enterprises have a large profit and the terminal still has a good support for the petroleum coke market.

It is expected that the second half of the year will be affected by both parties, and some coke prices may be adjusted slightly, but in general, the price of medium and high sulfur petroleum coke in China is still at

Post time: Jul-08-2021