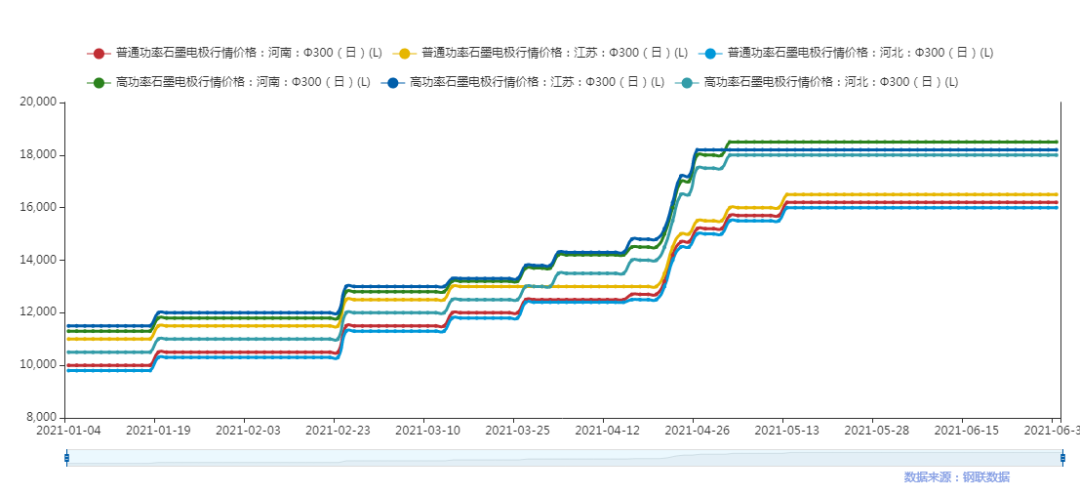

In the first half of 2021, the graphite electrode market will continue to rise. As of the end of June, the domestic mainstream market of φ300-φ500 ordinary power graphite electrodes was quoted at 16000-17500 yuan/ton, with a cumulative increase of 6000-7000 yuan/ton; φ300-φ500 high The mainstream market price of power graphite electrodes is 18000-12000 yuan/ton, with a cumulative increase of 7000-8000 yuan/ton.

According to the survey, the rise of graphite electrodes mainly has the following aspects:

First, it is affected by the continuous increase in raw material prices;

Second, in Inner Mongolia, Gansu and other regions, there was a power cut in March, and the graphitization process was limited. Many manufacturers could only turn to Shanxi and other regions for processing. The output of some electrode factories that required graphitization foundry was slowed down as a result. The supply of UHP550mm and below specifications is still tight, the price is firm, the increase is more obvious, and the ordinary and high-power graphite electrodes follow the increase;

Third, mainstream graphite electrode manufacturers have insufficient inventory, and orders have been placed until mid-to-late May.

On the market:

According to feedback from some electrode manufacturers, in the past, during the Spring Festival or so during the same period, they would purchase a certain amount of raw materials. However, in 2020, due to the continuous increase in the price of raw materials in December, manufacturers mainly wait and see. Therefore, the raw material inventory in 2021 is insufficient, and some manufacturers The usage will last until the Spring Festival. Since the beginning of 2021, due to public health incidents, most of the processing and related companies, which are the largest graphite electrode machining production base in the country, have suspended work and production, and the impact of road closures has caused transportation difficulties.

At the same time, the dual energy efficiency control in Inner Mongolia and the power cut in Gansu and other regions from January to March caused serious bottlenecks in the graphitization process of graphite electrodes. Until about mid-April, the local graphitization started slightly improved, but the production capacity was also released. It is only 50-70%. As we all know, Inner Mongolia is the center of graphitization in China. The dual control has some influence on the later release of semi-process graphite electrode manufacturers. Affected by the centralized maintenance of raw materials and the high cost of delivery in April, mainstream electrode manufacturers increased their product prices substantially twice in early and mid-to-late April, and the third and fourth echelon manufacturers slowly kept up in late April. Although the actual transaction prices were still somewhat favorable, But the gap has narrowed.

Until the “four consecutive drops” of Daqing petroleum coke, there was a lot of heated discussion in the market, and everyone’s mentality began to change slightly. Some graphite electrode manufacturers found that the prices of graphite electrodes of individual manufacturers were slightly loose during the bidding in mid to late May. However, because the domestic needle coke price remains stable and the supply of overseas coke will be tight in the later period, many leading graphite electrode manufacturers believe that the price of the later electrode will remain the status quo or slightly fluctuate. After all, the high-priced raw materials are still on the production line. Production, electrodes will still be affected by costs in the near future, it is unlikely that prices will fall.

Post time: Jul-21-2021