China is a large producer of petroleum coke, but also a large consumer of petroleum coke; In addition to domestic petroleum coke, we also need a large number of imports to meet the needs of downstream areas. Here is a brief analysis of the import and export of petroleum coke in recent years.

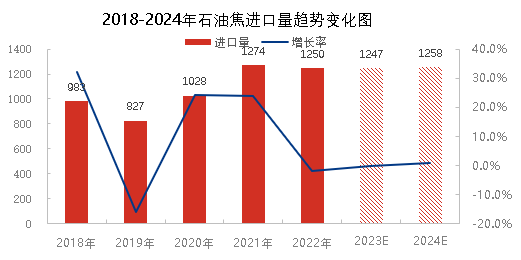

From 2018 to 2022, the import volume of petroleum coke in China will show an upward trend, reaching a record high of 12.74 million tons in 2021. From 2018 to 2019, there was a downward trend, which was mainly due to the weak domestic demand for petroleum coke. In addition, the United States imposed an additional 25% import tariff, and the import of petroleum coke decreased. From March 2020, import enterprises can apply for tariff exemption, and the price of foreign fuel petroleum coke is lower than that of domestic fuel petroleum coke, so the import volume is greatly increased; Although the import volume decreased in the second half of the year due to the impact of the foreign epidemic, it was generally higher than that in previous years. In 2021, under the influence of the implementation of dual control of energy consumption and production restriction policies in China, the domestic supply will be tight, and the import of petroleum coke will increase significantly, reaching a record high. In 2022, domestic demand will remain strong, and the total import volume is expected to reach about 12.5 million tons, which is also a big import year. According to the prediction of domestic downstream demand and the capacity of delayed coking unit, the import volume of petroleum coke will also reach about 12.5 million tons in 2023 and 2024, and the foreign demand for petroleum coke will only increase.

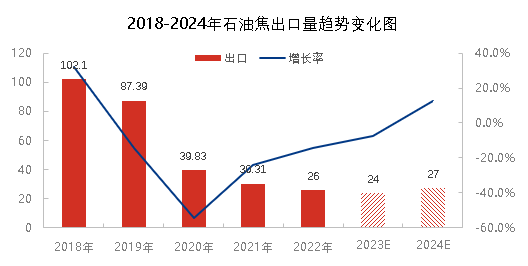

It can be seen from the above figure that the export volume of petroleum coke products will decline from 2018 to 2022. China is a large consumer of petroleum coke, and its products are mainly used for domestic demand, so its export volume is limited. In 2018, the largest export volume of petroleum coke was only 1.02 million tons. Affected by the epidemic in 2020, the export of domestic petroleum coke was blocked, only 398000 tons, a year-on-year decrease of 54.4%. In 2021, the supply of domestic petroleum coke resources will be tight, so while the demand will increase sharply, the export of petroleum coke will continue to decrease. The total export volume is expected to be about 260000 tons in 2022. According to the domestic demand and relevant production data in 2023 and 2024, the total export volume is expected to remain at a low level of about 250000 tons. It can be seen that the impact of petroleum coke export on domestic petroleum coke supply pattern can be described by the word "negligible".

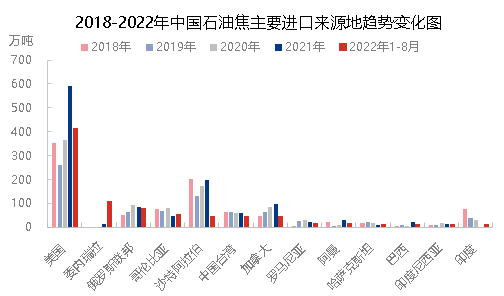

From the perspective of import sources, the structure of domestic petroleum coke import sources has not changed much in the past five years, mainly from the United States, Saudi Arabia, Russia, Canada, Colombia and Taiwan, China. The top five imports accounted for 72% - 84% of the total imports of the year. Other imports mainly come from India, Romania and Kazakhstan, accounting for 16% - 27% of the total imports. In 2022, domestic demand will increase significantly, and the price of petroleum coke will increase significantly. Influenced by international military action, low prices and other factors, Venezuela's coke imports will increase significantly, ranking the second largest importer from January to August 2022, and the United States will still rank the first.

To sum up, the import and export pattern of petroleum coke will not change significantly in recent years. It is still a large importing and consuming country. Domestic petroleum coke is mainly used for domestic demand, with a small export volume. The index and price of imported petroleum coke have certain advantages, which will also have a certain impact on the domestic market of petroleum coke.

Post time: Dec-23-2022